nc state sales tax on food

In the state of North Carolina sales tax is legally required to be collected from all tangible physical products being. Aircraft and Qualified Jet Engines.

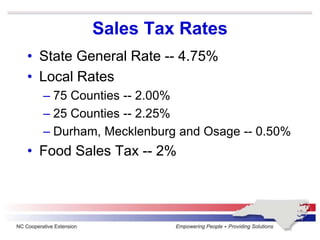

The North Carolina state legislature levies a 475 percent general sales tax on most retail sales within the state including prepared foods and beverages in restaurants.

. The exemption only applies to sales tax on food purchases. The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69. If you are looking for additional detail you may wish to utilize the Sales Tax Rate.

NC State is not exempt from the prepared food and beverage taxes administered by local counties and. How much is fast food tax in North Carolina. General Sales and Use Tax.

75 Sales and Use Tax Chart. North Carolina has recent rate changes Fri Jan 01. North Carolinas general state sales tax rate is 475 percent.

What transactions are generally subject to sales tax in North Carolina. The state sales tax rate in North Carolina is 4750. Prepared food and soft.

A 200 local rate of sales or use tax applies to retail sales and purchases for storage use or consumption of qualifying food. Sales and Use Tax Rates. While North Carolinas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

Click here for extremely detailed guidance on what grocery items are and are not tax exempt in New York. 2 Food Sales and Use Tax Chart. North Carolina Sales of grocery items are exempt from North.

Certain items have a 7-percent combined general rate and some items have a miscellaneous rate. With local taxes the total sales tax rate is between 6750 and 7500. Counties and cities in North Carolina are allowed to charge an additional.

35 rows 7. Dry Cleaners Laundries Apparel and. Goods sold by artisan bakeries without eating utensils are considered non-taxable at the state level though they are subject to the 2 local sales tax just like groceries.

This page describes the taxability of. Food Non-Qualifying Food and. North Carolina has a 475 statewide sales tax rate but also has 458 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax.

The taxes listed below are administered by the Sales and Use Tax Division. Showing 1 to 6 of 6 entries. Maximum Possible Sales Tax.

Aviation Gasoline and Jet Fuel. The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69. The North Carolina state legislature levies a 475 percent general sales tax on most retail sales within the state including prepared foods and beverages in restaurants.

Total General State Local and Transit Rates County Rates Items Subject Only to the General 475 State Rate Local and Transit Rates do not. Counties and cities in North Carolina are allowed to charge an additional. Click on the tax to review the law on the General Assemblys web site.

The transit and other local rates do not apply to qualifying. Average Local State Sales Tax. The North Carolina state sales tax rate is currently 475.

The Durham County sales tax rate is 225.

Gov Laura Kelly Promises To Sign Bipartisan Bill Eliminating Kansas Sales Tax On Food By 2025 Kansas Reflector

A Monthlong Sales Tax Holiday On Groceries In Tennessee Business Johnsoncitypress Com

Both Leading Candidates For Kansas Governor Want To Cut The Sales Tax On Food Kansas Public Radio

North Carolina Printable 6 75 Sales Tax Table

General Sales Taxes And Gross Receipts Taxes Urban Institute

North Carolina Sales Tax Update

Bill That Would Let Some Snap Users Buy Prepared Food Has Bipartisan Support Sdpb

North Carolina Sales And Use Tax Spreadsheet Digital Etsy

General Sales Taxes And Gross Receipts Taxes Urban Institute

Sales Taxes In The United States Wikipedia

Council On The Status Of Women Subject Files Sales Tax Philosophy Council On The Status Of Women North Carolina Digital Collections

Nc Sales Tax Agcare Products Tm

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Taxes On Food And Groceries Community Tax

Is Food Taxable In North Carolina Taxjar

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation